Rules Of Debit And Credit Pdf

- Debit Credit Rules Of Accounting

- Debit And Credit Rules Table

- Real Account Rules

- Golden Rules Of Debit And Credit Pdf

Debits and Credits Every transaction (sentence in the story of what happened to the money) has to have a debit and a credit. Accounting professionals use T-accounts to help them think through transactions and journal entries to record. Rules of debit and credit. The increase in machinery and decrease in cash must be recorded in the machinery account and the cash account respectively. As stated earlier, every ledger account has a debit and a credit side. Now the question is that on which side the. Another way to help remember debit and credit rules, is to think of the accounting equation as a tee (T), the vertical line of the tee (T) goes between assets and liabilities. Everything on the left side (debit side) increases with a debit and has a normal debit balance; everything on the right side (credit side) increases with a credit and has. If there is something that runs the world of accounting, it is the rules debit and credit. Without these rules, the world of accounting would be a haphazard mess. It is important that the accounts should be maintained properly on these rules. Let us study what a debit and credit are and how it.

If there is something that runs the world of accounting, it is the rules debit and credit. Without these rules, the world of accounting would be a haphazard mess. It is important that the accounts should be maintained properly on these rules, in order to ensure the accuracy of results displayed by such books of accounts. Let us study what a debit and credit are and how it works in accounts.

Suggested Videos

Debit and Credit in Accounting

Every business transaction which can be measured in monetary terms finds a place in the accounting transactions of a firm. In order to record such transactions, a system of debit and credit has been devised, which records such events through two different accounts.

The net effect of these accounting entries is the same in terms of quantity. However, by debiting and crediting two different accounts, the correct and apt accounting treatment can be depicted. In a ledger account, usually the debit column is on the left and the credit column is on the right.

- A debit is an accounting entry that either increases an asset or expense account. Or decreases a liability or equity account. It is positioned on the left in an accounting entry.

- A credit is an accounting entry that increases either a liability or equity account. Or decreases an asset or expense account. It is positioned on the right in an accounting entry.

Whenever an accounting transaction happens, a minimum of two accounts is always impacted, with a debit entry being recorded against one account and a credit entry being recorded against another account. There is no upper limit to the number of accounts involved in a transaction but the minimum cannot be less than two accounts.

The totals of the debits and credits for any transaction must always equal each other so that an accounting transaction is always said to be in balance. Thus, the use of debits and credits in a two column transaction recording format is the most essential of all controls over accounting accuracy. This is how debit and credit find their use.

Learn more about Sales Journal Book and Sales Return Book

Rules for Debit and Credit

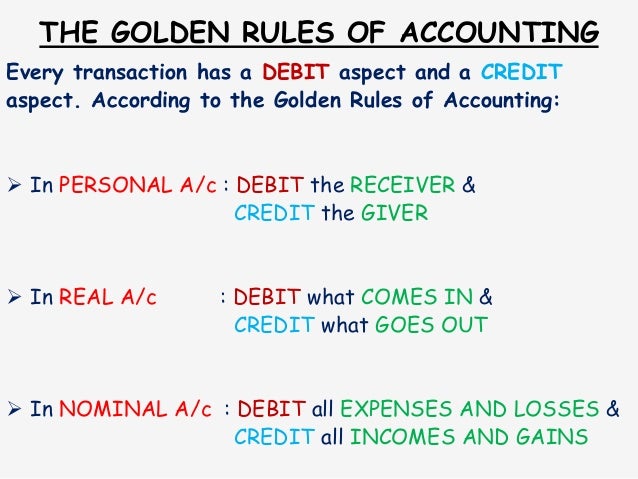

The following are the rules of debit and credit which guide the system of accounts, they are known as the Golden Rules of accountancy:

- First: Debit what comes in, Credit what goes out.

- Second: Debit all expenses and losses, Credit all incomes and gains.

- Third: Debit the receiver, Credit the giver.

Understand the concept of Business Transaction and Source Document here in detail.

A debit and credit entry have a broad impact on different accounts. For example, in

- Asset accounts, a debit increases the balance and a credit decreases the balance.

- Liability accounts, a debit decreases the balance and a credit increases the balance.

- Equity accounts, a debit decreases the balance and a credit increases the balance.

- Revenue accounts, a debit decreases the balance and a credit increases the balance

Solved Question for You

Question: Provide journal for the following transactions –

- Cash Sale

- Cash Purchase

- Repayment of loan

Solution:

- Sale for cash

Cash A/c – Dr.

To Sale A/c

- Purchase of inventory from the supplier for cash

Inventory A/c – Dr.

To Cash A/c

- Repaying a loan

Loan payable A/c – Dr.

To cash A/c

A ledger account (also known as T-account) consists of two sides – a left hand side and a right hand side. The left hand side is commonly referred to as debit side and the right hand side is commonly referred to as credit side. In practice, the term debit is denoted by “Dr” and the term credit is denoted by “Cr”.

In the rest of the discussion we shall use the terms debit and credit rather than left and right.

When a financial transaction occurs it affects at least two accounts. For example, purchase of machinery for cash is a financial transaction that increases machinery and decreases cash because machinery comes in and cash goes out of business. The increase in machinery and decrease in cash must be recorded in the machinery account and the cash account respectively. As stated earlier, every ledger account has a debit and a credit side. Now the question is that on which side the increase or decrease in an account is to be recorded. The answer lies in the learning of normal balances of accounts and the rules of debit and credit.

Normal balance of accounts

The understanding of normal balance of accounts helps understand the rules of debit and credit easily. If the normal balance of an account is debit, we shall record any increase in that account on the debit side and any decrease on the credit side. If, on the other hand, the normal balance of an account is credit, we shall record any increase in that account on the credit side and any decrease on the debit side.

The normal balance of all asset and expense accounts is debit where as the normal balance of all liabilities, and equity (or capital) accounts is credit. The normal balance of a contra account (discussed later in this article) is always opposite to the main account to which the particular contra account relates.

Rules of debit and credit

(1). Asset accounts:

Normal balance: Debit

Rule: An increase is recorded on the debit side and a decrease is recorded on the credit side of all asset accounts.

(2). Expense accounts:

Normal balance: Debit

Adobe cs5 serial number list. Rule: An increase is recorded on the debit side and a decrease is recorded on the credit side of all expense accounts.

(3). Liability accounts:

Debit Credit Rules Of Accounting

Normal balance: Credit

Rule: An increase is recorded on the credit side and a decrease is recorded on the debit side of all liability accounts.

(4). Revenue/Income accounts:

Normal balance: Credit

Rule: An increase is recorded on the credit side and a decrease is recorded on the debit side of all revenue accounts.

(5). Capital/Equity accounts:

Normal balance: Credit

Rule: An increase is recorded on the credit side and a decrease is recorded on the debit side of all equity accounts.

This fantastic version of the popular card game features incredible graphics, a helpful undo feature and a set of twelve of the most popular pyramid solitaire games in the world. Download free full version game and start playing the pyramid solitaire now! One of the most popular and addictive solitaire variations, Amber Pyramid Solitaire is perfect for a quick break or a few hours of fun. Free download of pyramid solitaire.

(6) Contra accounts:

Normal balance: Opposite to the normal account.

An example:Accounts receivable is an asset account that normally has a debit balance. The allowance for doubtful accounts is a contra account to the accounts receivable and normally has a credit (opposite) balance.

Other examples of contra accounts include:

- accumulated depreciation account – a contra asset account

- sales returns and allowances account – a contra revenue account

- sales discount account – a contra revenue account

- drawings account – a contra equity account

- treasury stock account – a contra equity account

- bonds discount account – a contra liability account

As the normal balance of a contra account is always opposite to the normal balance of the relevant main account, it causes a reduction in the reporting amount of the main account.

Rule: If the normal balance of the contra account is debit, the increase will be recorded on the debit side and the decrease will be recorded on the credit side. If, on the other hand, the normal balance of the contra account is credit, the increase is recorded on the credit side and the decrease is recorded on the debit side.

Debit And Credit Rules Table

A summary of the whole discussion about rules of debit and credit is given below:

The following example may be helpful to understand the practical application of rules of debit and credit explained in above discussion

Example:

Real Account Rules

The following transactions are related to Small Traders:

- Started business with cash $95,000.

- Furniture purchased for cash to be used in business $8,000.

- Purchased goods for cash $40,000.

- Purchased goods on credit from Big Traders $57,000.

- Sold goods for cash $5,000.

- Purchased equipment for business $4,000.

- Sold goods on credit to John Retailers $1,500.

- Paid salary to employees $1,200

Golden Rules Of Debit And Credit Pdf

Required: Identify the accounts involved in above transactions and state the nature of each account. Also mention how increases or decreases in accounts resulting from above transactions should be recorded.